The project is an integrated commercial center, consisting of entertainment and shopping centers, shops, restaurants, and parking lots. The project services are (shops – entertainment venues – restaurants – health club – residential units – medical center – car wash – nursery). The commercial center targets the service sector and the commercial sector to benefit from the increased demand for those services provided by the project due to the development of the targeted sectors.

The project consists of entertainment and shopping centers, retail stores, shops, and restaurants. It also includes a health club, residential units, a medical center, a car wash, and a daycare center.

Notably, the commercial center stands out for its diverse services and its ability to serve a large population with high-quality offerings at competitive prices. Residents prefer shopping at commercial centers due to their wide range of services, which cater to different sectors and meet the needs of the public. As the population grows and shopping trends evolve, demand for the center’s services continues to rise.

The commercial center will operate with experienced administrative and technical staff, utilizing the best methods and highest quality standards. It will ensure the availability of all necessary supplies, goods, services, and equipment to meet consumer needs efficiently.

The project aims to create sustainable urban coordination zones, attract visitors, and provide essential services to targeted sectors. Additionally, it seeks to capture the largest possible share of the market gap, positioning itself as a key player in the commercial and entertainment landscape.

Executive Summary

Study of project services/products

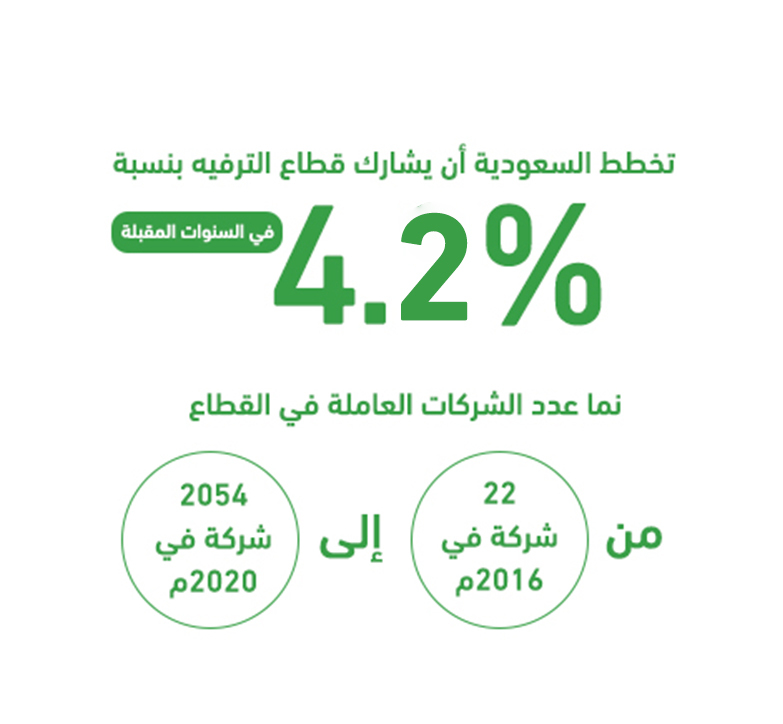

Market size study.

Risk assessment study.