The project is to establish a factory to produce and manufacture tahini and halva tahini. The factory produces and manufactures a wide range of tahini and halva tahini products in various packages and sizes of tahini products such as (250 gram tahini package – 500 gram tahini package – 1,000 gram tahini package – 5 kg tahini package)

The project is to establish a factory for the production and manufacture of tahini and halva tahini. The factory produces and manufactures a wide range of tahini and halva tahini products in various packages and sizes of tahini products such as (250 gram tahini package – 500 gram tahini package – 1,000 gram tahini package – 5 kg tahini package) in addition to a wide range of halva tahini products such as (plain halva tahini – with chocolate – with pistachios) in packages and sizes of 250 grams, 500 grams, and 750 grams. This is done by using the best available production lines that produce and package tahini and halva tahini. The factory seeks to provide its products with high quality and competitive prices. The factory also seeks to replace its products with imported products of tahini and halva. The tahini and halva factory is one of the projects that are characterized by high demand for its products. Establishing a factory to produce tahini and halva is one of the projects that can accommodate the targeted sectors of individuals, restaurants, hotels, supermarkets and hypermarkets, as the project seeks to benefit from the development in the food industry and the increase in population numbers. Therefore, establishing a factory to produce tahini and halva is considered one of the great investment opportunities that achieve high economic returns.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

The GCC countries comprise only 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages, amounting to $102 billion out of a total of $3.4 trillion. This indicates a high per capita food consumption in the region, exceeding the global average.

This is not surprising when we take a closer look; the population of the GCC countries now exceeds 58 million, with approximately 56.3% of them falling within the age group of 25 to 54 years. This vital and youthful demographic forms the backbone of the food industry market, being the most dynamic compared to other age groups.

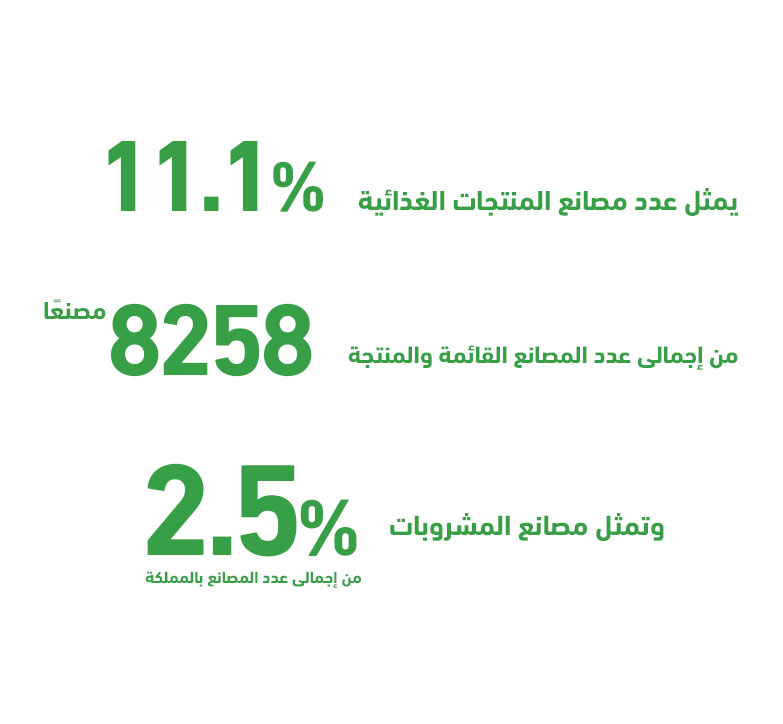

Saudi Arabia alone accounts for around 59.7% of the total GCC population and holds over 53% of the region’s food and beverage market share. Given this, “Mashro3ak” has decided to present key indicators of this vital market in the Kingdom, based on the latest available statistics.