From our experience in the market, we have observed that consumers in the GCC are loyal and increasingly interested in new and innovative products, a factor that is driving demand for non-core soft drink segments such as energy drinks, which are expected to witness strong growth.

From our experience in the market, we have noticed that consumers in the GCC are increasingly loyal and interested in new and innovative products, a factor that is driving demand for non-core soft drink segments such as energy drinks, which are expected to witness strong growth. Over the past few years, we have observed strong growth in consumer demand for such products. This trend has in turn been accompanied by strong demand for imports of these products, making it one of the investment opportunities that must be exploited. The project relies on the latest technologies that help reduce costs and increase production speed. <Soft drinks are the second most consumed beverage after water. Increasing population and rising disposable income have led to an increase in demand for soft drink products across the globe. These benefits have led to a growth in demand. Packaging and marketing solutions are also playing a major role in the growth of this sector. Another trend that is driving the demand is new and innovative products, which help manufacturers boost their brand visibility while offering a competitive advantage to these products. <br>On this basis, our feasibility study report helps you map the current potential of the market, get the best insights on the target brands, best-selling packaging types and sizes, evaluate distributors in terms of financial status and access to retailers and distributors for these products, as well as determine the market size, performance of the target brands and flavours, competition, supply chain and trade terms, and also provide an overview of the macro-level drivers and barriers in the beverage industry.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

he GCC countries comprise 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages, amounting to $102 billion out of a total of $3.4 trillion. This indicates a high per capita food consumption in the region, exceeding the global average.

This is not surprising upon closer examination, as the population of the GCC now exceeds 58 million, with approximately 56.3% of them falling within the 25–54 age group. This key demographic is the driving force behind the food industry market, as it is the most dynamic and youthful segment.

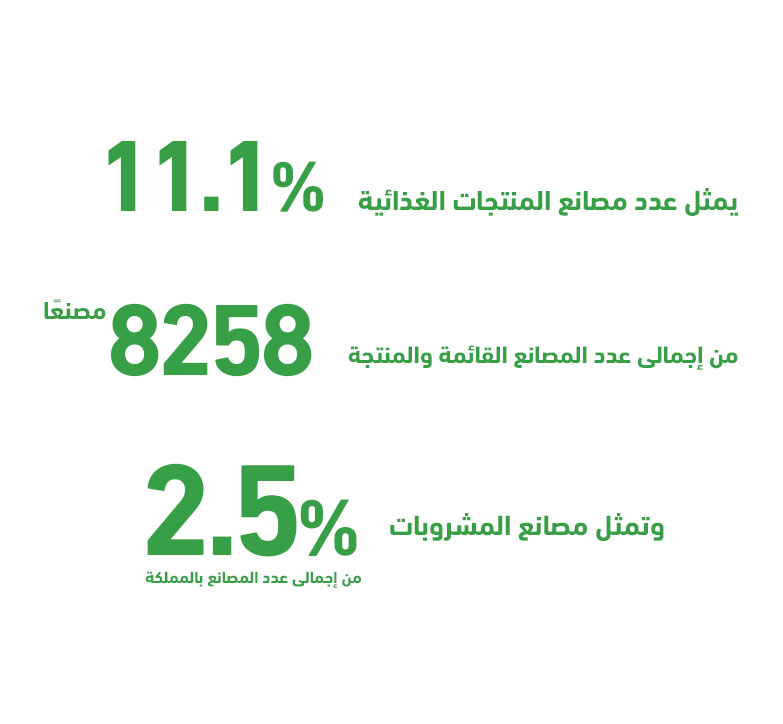

Since Saudi Arabia alone accounts for about 59.7% of the total GCC population and holds over 53% of the food and beverage market share, “Mashroo3k” has decided to present key indicators of this vital market in the Kingdom, based on the latest available statistics.