Mashroo3k Economic Consulting offers a feasibility study for an equestrian school project in the Kingdom of Saudi Arabia, ensuring the highest profitability and optimal payback period. The study is based on detailed analyses of the Saudi market size, evaluation of local and international competitors’ strategies, and the provision of competitive pricing offers.

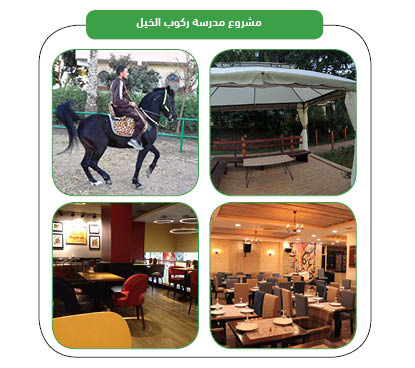

The equestrian school offers a range of training programs for teaching horse riding to both genders of all ages. The equestrian school also offers several recreational activities, country trips, and horse dancing. The project targets amateurs and those looking for entertainment, and Mashro3ak consultants expect the school to include specialized programs to train professionals and qualify them for sports championships.

Mashroo3k Economic Consulting Company provides investors wishing to invest in an equestrian school project in Saudi Arabia with: A range of specialized feasibility studies. It is based on up-to-date databases specific to the Saudi market. What makes a project successful. and maximize profitability. and the best payback period.

Mashroo3k Economic Consulting Company directs investors who wish to invest in an equestrian school project in Saudi Arabia, or develop their existing projects, to seek the opinions of specialized consultants through Mashroo3k Company, to help them determine the best suitable devices to start or develop the project, and the best medical expertise in the field of eye care and treatment, in order to develop the center’s services and raise its competitive advantages.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

After many years of relying on oil and gas, the Kingdom of Saudi Arabia announced its alternative plan and ambitious Vision 2030 program, aiming to diversify national income sources and ensure sustainable development. Therefore, it was not surprising that the state dedicated its efforts and resources to supporting non-oil economic sectors to develop, enhance their efficiency, and increase their contribution to the gross domestic product. We have witnessed how Saudi Arabia provided the success factors for these sectors, achieving its goals. The continuous financial indicators and statistics have repeatedly proven the feasibility of the path the Kingdom has committed to since April 2016. At the forefront of the sectors that the Kingdom has given special attention to is the entertainment sector. To support its growth, Saudi Arabia established the General Entertainment Authority and the Saudi Entertainment Ventures Company (a subsidiary of the Public Investment Fund). Additionally, the Kingdom recently introduced incentive laws and new regulations aimed at opening the door for the private sector to actively contribute to the development of this promising industry.

As a result of these efforts, Saudi Arabia has achieved significant gains, attracting billions of dollars from both domestic and international investors. Over just four years, more than 46 million people attended entertainment events, while the number of event days surpassed 26,000. Furthermore, the sector successfully created 101,000 job opportunities for Saudi youth, both men and women. And because “Mashroo3k” Consulting for economic advisory and market research always backs its statements with verified data, we will present below the key indicators, statistics, and data of the entertainment sector. This will provide you with a clear picture of its feasibility and reassure you about the investment potential it holds.

The entertainment sector is considered one of the most promising industries in the Kingdom, as it has successfully retained over 78 billion riyals that were previously spent abroad on entertainment and related activities. Recognizing the sector’s importance and its ability to compete with other industries, Saudi Arabia has been expanding its efforts by establishing more museums and mobilizing its resources for major projects. Like this: Qiddiya and the Red Sea Project are among the major initiatives that underscore Saudi Arabia’s commitment to developing its entertainment and tourism sectors. Available data confirms the effectiveness of the steps the Kingdom has taken to position itself among the top 10 global tourist destinations.