تقدم شركة مشروعك للاستشارات الاقتصادية، دراسة جدوى لمشروع مصنع بطاطس شيبسي ومقرمشات، بأعلى عائد ربحي، وأفضل فترة استرداد، من خلال مجموعة من الدراسات الدقيقة لحجم السوق السعودي، وتحليل استراتيجيات المنافسين المحليين والأجانب، وتقديم عروض أسعار تنافسية.

Potato chips are one of the food industries that are increasingly popular among consumers. Therefore, the idea of establishing a new potato chips and crisps factory is one of the successful project ideas implemented by Mashroo3k Economic Consulting Company in the Saudi market.

The potato chips manufacturing process begins with peeling the potatoes, cutting them into thin slices, then the frying process begins, then adding some spices and flavor enhancers, and adding preservatives, to preserve the product’s shelf life for as long as possible. The potato chips and crisps factory products target a wide range of consumers, such as wholesalers and retailers, small shops, and various supermarkets.

Chips are food products that have high consumption and are highly competitive in the Saudi market. Therefore, one of the priorities of Mashroo3k Company, when planning to establish a potato chips and crisps factory, was to conduct a detailed marketing study that clarifies the market situation and available marketing opportunities, so that the competitive advantages of the products can be developed and the highest return on profit can be achieved.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

he GCC countries comprise 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages, amounting to $102 billion out of a total of $3.4 trillion. This indicates a high per capita food consumption in the region, exceeding the global average.

This is not surprising upon closer examination, as the population of the GCC now exceeds 58 million, with approximately 56.3% of them falling within the 25–54 age group. This key demographic is the driving force behind the food industry market, as it is the most dynamic and youthful segment.

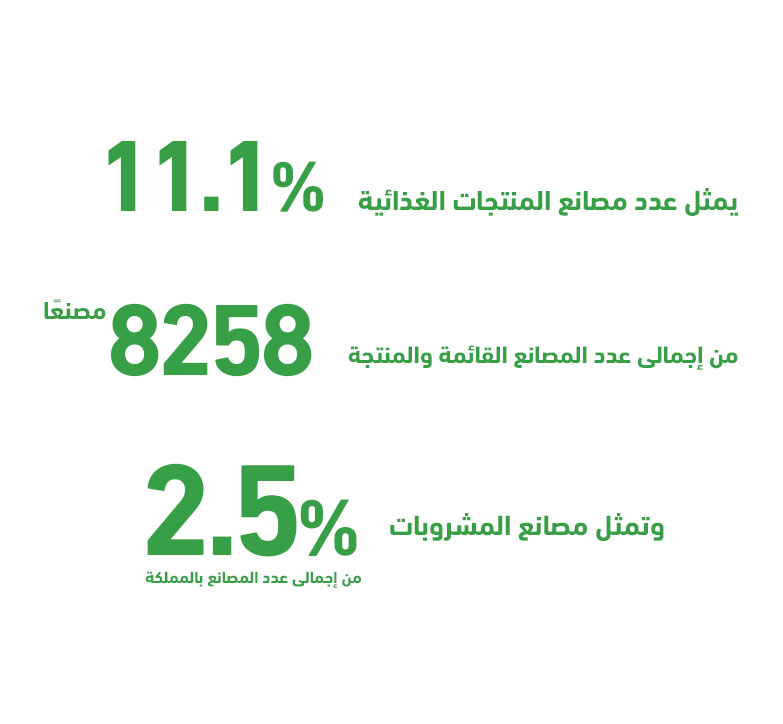

Since Saudi Arabia alone accounts for about 59.7% of the total GCC population and holds over 53% of the food and beverage market share, “Mashroo3k” has decided to present key indicators of this vital market in the Kingdom, based on the latest available statistics.