It is a factory specialized in the processing and manufacturing of processed meats. The factory will manufacture (luncheon meat). The factory produces and packages the sauce and ketchup used in the food and beverage sector. The packaging is done using the best packaging materials to preserve the quality of the food products.

It is a factory specialized in the processing and manufacturing of processed meat.<Where the factory will manufacture (luncheon meat)<The factory targets hotels, restaurants, wholesale and retail stores, hypermarkets and supermarkets.<The importance of the project comes from covering the food gap for processed meats by establishing an integrated project for meat processing and the production of (luncheon meat).<With good specifications and reducing and limiting the import of the products under study resulting from the increasing demand for processed meat products and facing the increasing volume of consumption.<Meat manufacturing is one of the most important industries currently prevalent.<The project is based on establishing food industries specialized in meat processing. This industry deals with preparing it in a variety of ways in order to satisfy the largest number of consumers. <It is distinguished by the quality of its products and raw materials, the presence of a number of technicians and production supervisors who are efficient and sort food materials before the packaging process.<And attention to the general cleanliness of the factory, the packing area, and other features that distinguish the factory.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

he GCC countries comprise 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages, amounting to $102 billion out of a total of $3.4 trillion. This indicates a high per capita food consumption in the region, exceeding the global average.

This is not surprising upon closer examination, as the population of the GCC now exceeds 58 million, with approximately 56.3% of them falling within the 25–54 age group. This key demographic is the driving force behind the food industry market, as it is the most dynamic and youthful segment.

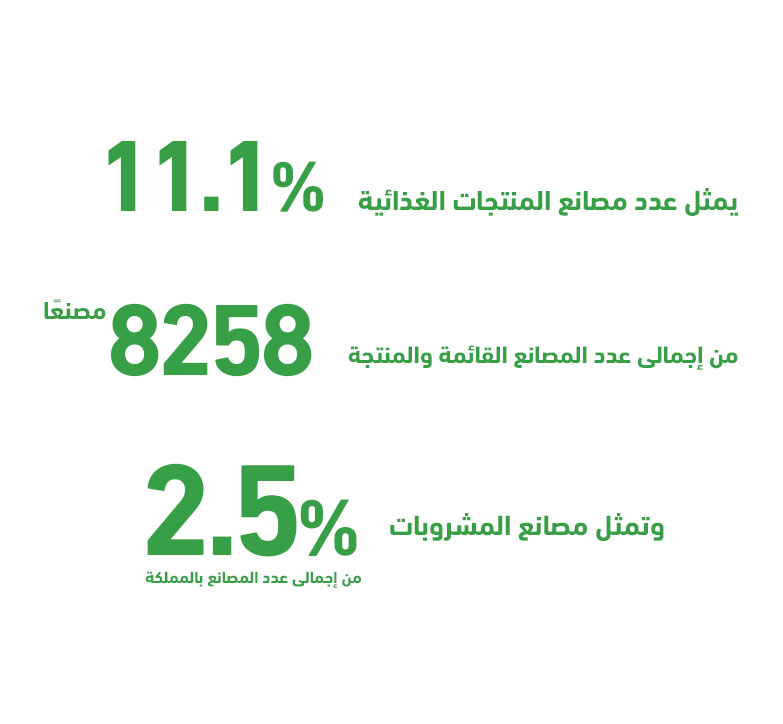

Since Saudi Arabia alone accounts for about 59.7% of the total GCC population and holds over 53% of the food and beverage market share, “Mashroo3k” has decided to present key indicators of this vital market in the Kingdom, based on the latest available statistics.