The poultry products sector is growing at a CAGR of 6% in terms of value and 20% in terms of volume. This sector is growing at a faster pace compared to other sectors. The most influential factor in this sector is the increase in per capita consumption of eggs and egg powder.

The poultry products sector is growing at a CAGR of 6% in terms of value and 20% in terms of volume. This sector is growing at a faster pace compared to other sectors. The most influential factor in this sector is the increase in per capita consumption of eggs and egg powder, as people are moving towards protein supplements. In recent times, changing eating habits and awareness about nutrition have become a reason for the increasing demand for poultry products. The demand for egg products is expected to increase in the coming years, as eggs are the cheapest major source of protein and vitamins, which shows that there are some great opportunities to enter this sector. The project also has a unit for producing feed needed to operate the farm with the aim of achieving self-sufficiency. The project targets many sectors such as hypermarkets, supermarkets, wholesalers and retailers, hotels, restaurants, markets and associations, fertilizer distributors, and various food factories.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

he GCC countries comprise 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages, amounting to $102 billion out of a total of $3.4 trillion. This indicates a high per capita food consumption in the region, exceeding the global average.

This is not surprising upon closer examination, as the population of the GCC now exceeds 58 million, with approximately 56.3% of them falling within the 25–54 age group. This key demographic is the driving force behind the food industry market, as it is the most dynamic and youthful segment.

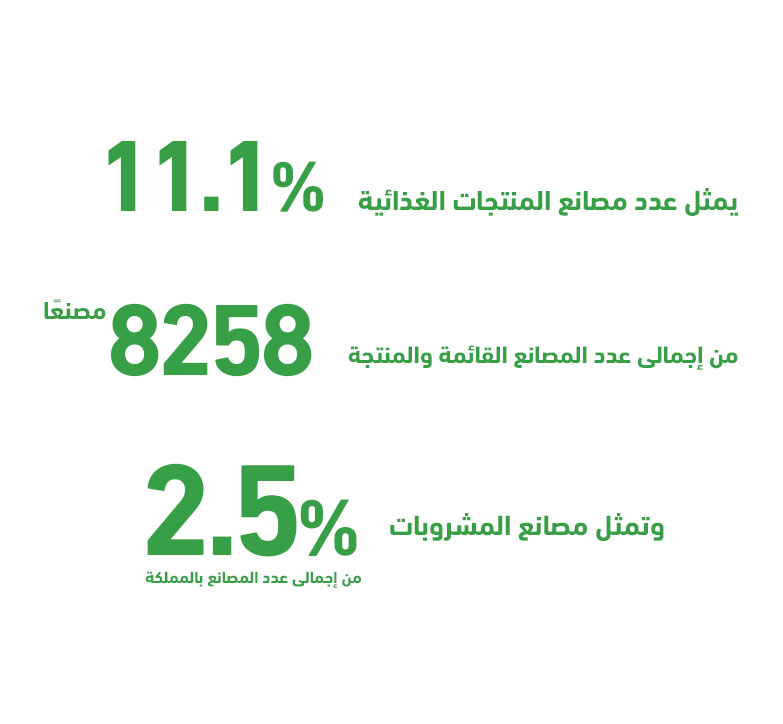

Since Saudi Arabia alone accounts for about 59.7% of the total GCC population and holds over 53% of the food and beverage market share, “Mashroo3k” has decided to present key indicators of this vital market in the Kingdom, based on the latest available statistics.