There is a very strong growing demand for additional supplies of seafood products which, as in many countries, has given impetus to increased supplies to local fish markets.

There is a very strong growing demand for additional supplies of seafood products which as in many countries has given impetus to increased supplies to local fish markets. This trend is expanding not only in the GCC countries but all over the world. All indications are that this development in the growing demand for seafood commodities has no chance of abating especially in the GCC countries and is expected to increase in the coming years. <Many markets have reported an increase in demand for frozen and pre-packaged seafood, due to the significant increase in meat and poultry prices. Many experts also point out that frozen fish contains a higher level of nutrients compared to fresh fish. When fish is caught in the sea, it is processed and frozen immediately, at a temperature of -40 degrees Celsius within a few hours. This procedure reduces natural oxidation, preserves freshness, prevents microbial growth and loss of nutrients. In fact, this product offers several times higher nutritional quality than fresh fish that can be found in the markets. The freezing technology also allows for the consumption of seasonal fish throughout the year at great prices and with healthy nutrition for the whole family. <This project may be one of the projects that provide huge profits throughout the year, as it is characterized by being one of the projects with a fast capital cycle, due to its multiple branches, and following the best modern freezing techniques and providing the appropriate place, with the presence of a highly efficient work team capable of adhering to international standards to preserve such products during preparation and presentation, and the project targets many sectors such as hotels, restaurants, and retailers.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

The GCC countries comprise only 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages, amounting to $102 billion out of a total of $3.4 trillion. This indicates a high per capita food consumption in the region, exceeding the global average.

This is not surprising when we take a closer look; the population of the GCC countries now exceeds 58 million, with approximately 56.3% of them falling within the age group of 25 to 54 years. This vital and youthful demographic forms the backbone of the food industry market, being the most dynamic compared to other age groups.

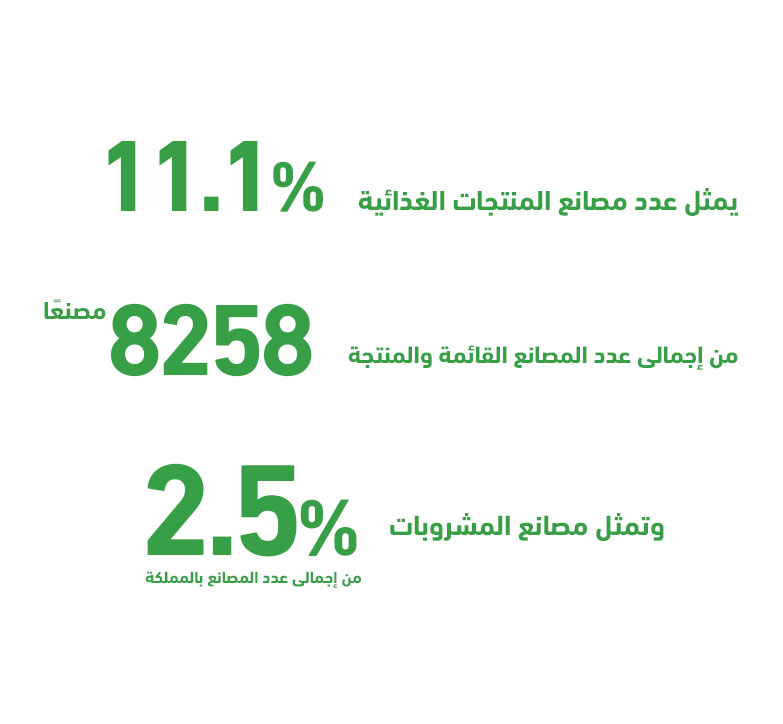

Saudi Arabia alone accounts for around 59.7% of the total GCC population and holds over 53% of the region’s food and beverage market share. Given this, “Mashro3ak” has decided to present key indicators of this vital market in the Kingdom, based on the latest available statistics.