Mashroo3k Economic Consulting Company offers a feasibility study for a gift shop and party supplies project in Saudi Arabia, with the highest return on investment and the best payback period, through a set of accurate studies of the size of the Saudi market, an analysis of the strategies of local and foreign competitors, and the ability to provide competitive price offers.

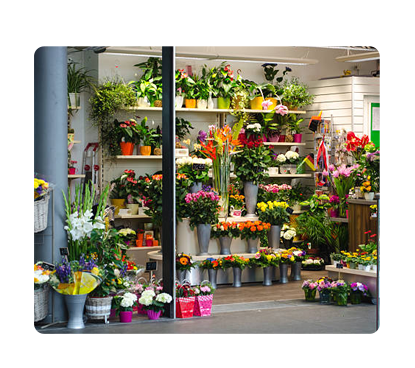

Flowers and gifts are widely popular products. Mashroo3k Economic Consulting Company directs investors who wish to invest in Saudi Arabia to invest in a flower and gift shop based on accurate studies from Mashroo3k Company and updated databases on the supply and demand rate of gift and party supplies in the Saudi market.

Mashroo3k Economic Consulting Company directs investors who wish to invest in a flower and gift shop project in Saudi Arabia, or develop their existing projects, to seek the opinions of specialized consultants through Mashroo3k Company, to help them determine the best ways and methods to develop the shop’s services and increase its competitive advantages.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

According to the theory of macroeconomics of sectors, the economy is divided into three main and large sectors: The first sector involves the collection of raw materials and includes mining companies, timber companies, oil exploration companies, as well as agricultural industries and fishing. As for the second sector, it is the sector that relies on goods and their sale.

Like this: (The automobile industry, furniture, clothing trade, etc.). The third sector, known as the “services” sector, is responsible for providing and producing services that are fundamentally intangible. This sector includes various industries such as transportation, healthcare, education, finance, tourism, hospitality, and more, focusing on delivering services rather than physical goods.

Like this: Entertainment, healthcare, transportation, hospitality, restaurants, and more are part of the services sector. This theory suggests that as countries advance, their economies are increasingly based on the third sector, in contrast to developing or less advanced countries that largely depend on the first sector (for example, in the United States, the services sector makes up 85% of the economy). The shift towards a service-based economy reflects the increasing demand for intangible services as societies modernize and diversify.

Kingdom of Saudi Arabia:

The service sector is considered a large sector when we closely examine its activities. It includes: wholesale and retail trade, restaurants and hotels, transportation, storage, information and communications, financial services, insurance, real estate, business services, community, social, and personal services, and finally, government services. Below, we will present the key indicators of the sector in Saudi Arabia.

The State of Qatar:

State of Kuwait:

United Arab Emirates:

Sultanate of Oman:

Kingdom of Saudi Arabia: