Delivery app provides various delivery services such as: Food and beverage, medications, furniture, clothes, personal staff, and others. This app intends to simplify and accelerate the order delivery process, providing a reliable and efficient tool to meet the customers’ needs without leaving their homes, making it an ideal option for enhancing comfort and well-being.

Delivery app provides various delivery services such as: Food and beverage, medications, furniture, clothes, personal staff, and others. This app intends to simplify and accelerate the order delivery process, providing a reliable and efficient tool to meet the customers’ needs without leaving their homes, making it an ideal option for enhancing comfort and well-being.

Our company , Mashroo3k for Economic Consulting, is pleased to provide a feasibility study for a delivery app based on a vast database that helps to present a detailed analysis of the volume of the target market, marketing gap, competitors, consumer market, opportunities, threats, strengths and weaknesses.

The study we provide intends to cover the important technical aspects of the project, such as location, production capacity, equipment and machines required for operation, as it also covers a comprehensive analysis of the project financial indicators, such as payback period, break-even point, and others. Our study provides investors with a comprehensive horizontal view of all the financing, operational, and marketing elements of the project

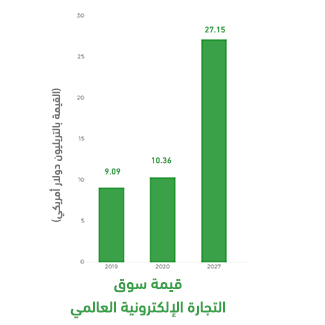

Overview of the statistics of E-commerce in the GCC countries: