A company that stores and exports dates. The company buys large quantities of dates during the palm fruit season from farms and the market to store, invest and re-export them.

A company that stores and exports dates. The company purchases large quantities of dates during the palm fruit season from farms and the market to store, invest and re-export them. This aims to exploit the available resources in the country and contribute to achieving the country’s vision by marketing dates and their derivatives to increase their consumption locally and globally. The demand for the project’s products is high due to their multiple benefits and uses. The project’s products are used in the feeding process, in the food pastry industry and other numerous uses for the project’s products. The project is developing integrated production methods to harmonize quality controls at the level of date storage and at the level of exporting them. This is to provide clean, fresh and identical products in terms of color, size and shape, and free of impurities. This is to meet the increasing demand in the local and regional market for date products, as the sectors targeted by the project are diverse, including food factories (pastries, sweets, bakeries, sweet shops, wholesale and retail shops, supermarkets, hypermarkets, hotels and furnished apartments). In addition to exporting to other countries, as the demand for the project’s products is characterized by increase and continuity due to the increase in population numbers, in addition to the high rates of consumption of dates and the continuous increase in the number of targeted sectors.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

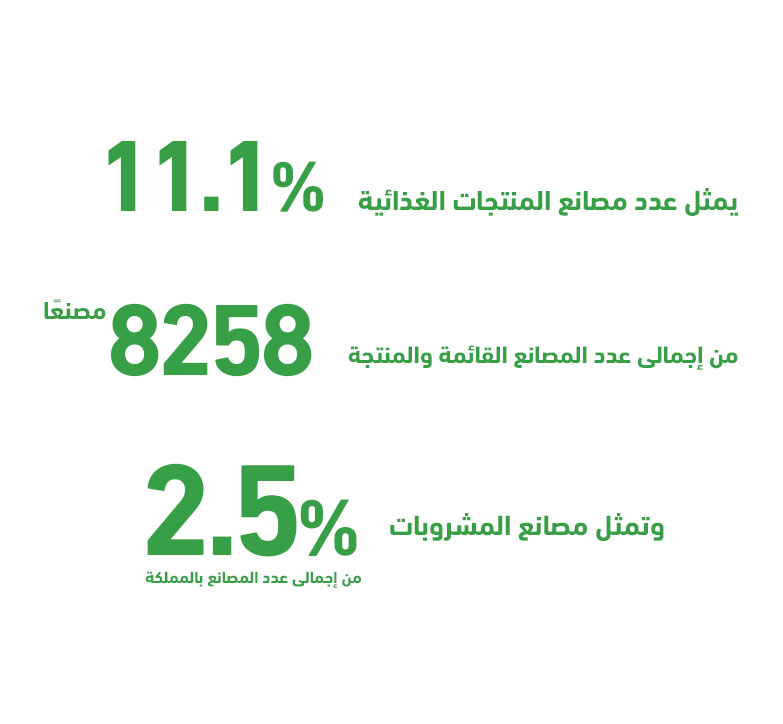

he GCC countries comprise 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages, amounting to $102 billion out of a total of $3.4 trillion. This indicates a high per capita food consumption in the region, exceeding the global average.

This is not surprising upon closer examination, as the population of the GCC now exceeds 58 million, with approximately 56.3% of them falling within the 25–54 age group. This key demographic is the driving force behind the food industry market, as it is the most dynamic and youthful segment.

Since Saudi Arabia alone accounts for about 59.7% of the total GCC population and holds over 53% of the food and beverage market share, “Mashroo3k” has decided to present key indicators of this vital market in the Kingdom, based on the latest available statistics.