The business incubator is an integrated platform aimed at supporting entrepreneurs and owners of startups during the early stages of the establishment of their projects. The incubator provides a set of comprehensive services that include logistical support, such as providing common work spaces equipped with the latest technologies, as well as financial facilities such as soft loans and financing support to alleviate financial burdens on new projects. The incubator is also developing innovative marketing strategies that help startups to reach its target audience and increase their chances of success in the market. In addition, the incubator provides human resource guidance and management services, which helps in building strong and effective work teams capable of achieving the desired goals. The business incubator also plays an important role in solving administrative problems and organizing the internal processes of projects, which contributes to raising operational and productive efficiency. Through its continuous support, business incubators contribute to enhancing the contribution of small and medium enterprises to gross domestic product, creating new job opportunities, and reducing unemployment rates, which makes them one of the most important tools of sustainable economic development.

<strong>The Business Incubator</strong> is one of the vital projects that aim to provide comprehensive support to entrepreneurs and startups, which contributes to achieving sustainability and growth for small and medium enterprises. The incubator is distinguished by its ability to build strong relationships with government agencies, which contributes to facilitating procedures and providing an environment conducive to the success of projects. The incubator also provides various services including logistical support, professional guidance, and practical training, in addition to financing facilities that allow startups to launch steadily in the market. < < >strong>The Business Incubator<strong> has a distinct and vital location that makes it accessible to everyone, in addition to its ability to build strategic partnerships with investors and financial institutions, which provides additional support to entrepreneurs. It is also distinguished by its diverse sources of revenue, which ensures its continuity and flexibility in the face of economic challenges. Moreover, the incubator contributes to opening new markets for startups, which enhances their opportunities for expansion and growth. Thanks to this diversity and distinction, <Business Incubator

< a strategic choice for anyone looking for comprehensive and integrated support, and a profitable investment opportunity with sustainable growth potential.

Executive Summary

Study of project services/products

Market Size Study

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

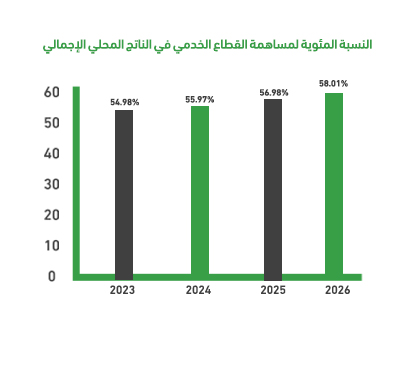

The service sector does not rely on raw materials or goods for sale; rather, its activities are centered around providing intangible services. Like this: Transportation services, hospitality services, healthcare services, and others. This sector is considered the main driver of major economies; for example, in the United States, the service sector accounts for 85% of the GDP. As for the service sector in Saudi Arabia, statistics and indicators confirm its contribution of about 48.02% to the GDP. This vital sector includes five main activities.

Namely:

The Gross Domestic Product (GDP) in Saudi Arabia reached 2,625,442 million SAR, with the “Wholesale and retail trade, restaurants, and hotels” sector contributing approximately 10.8% (284,579 million SAR).

Contributes approximately 6.6% (172,304 million SAR).

The Financial, Insurance, Real Estate, and Business Services sector contributes approximately 6.4% (SAR 377,725 million) to the Gross Domestic Product (GDP).

This sector contributes approximately 2.5% (SAR 65,729 million) to the Gross Domestic Product (GDP).

It contributes 21.9% (SAR 576,089 million) to the Gross Domestic Product (GDP).