The Saudi National Bank is one of the largest and most prestigious financial institutions in the Kingdom of Saudi Arabia. It began its operations under a royal decree on December 26, 1953. The bank plays a key role in the economic transformation of Saudi Arabia, with its activities successfully bringing about a qualitative shift in the Saudi banking sector. Thanks to its substantial financial capabilities, it contributes to fulfilling the aspirations and ambitions of future projects supporting Vision 2030.

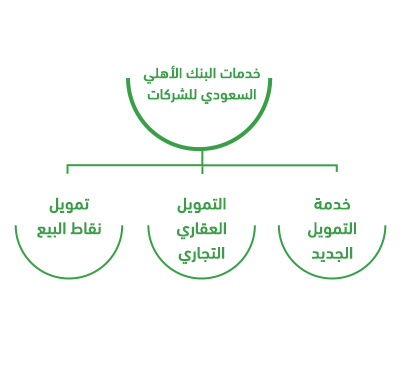

The National Commercial Bank of Saudi Arabia provides several financing services to companies in the government and private sectors, approved and unapproved, including:

1. New Financing Service

It is a service that allows companies to transfer their employees’ salaries to the National Commercial Bank of Saudi Arabia, through a fast salary transfer system. This service provides immediate cash liquidity in amounts up to 1.5 million riyals

2. Commercial Real Estate Financing

It is a commercial real estate financing program to support the corporate sector and small and medium enterprises, as the program provides the necessary financing to purchase ready commercial properties located within the urban area through a financing mechanism that complies with Sharia controls. This program supports many activities, such as: industry, medical facilities, transportation and services. Joint financing with the “Kafala” program.

3. Point of Sale Financing

Financing services include the point-of-sale financing service, which allows increasing sales revenues by obtaining financing from the National Commercial Bank, with a value of up to 5 million Saudi riyals, and a repayment period of up to 36 months.

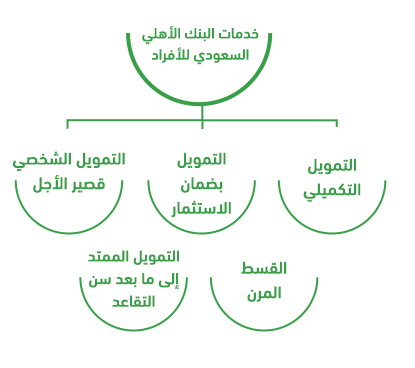

The National Commercial Bank of Saudi Arabia offers, Financial services Many for individuals from the private sector, with amounts reaching 1,500,000 riyals, in installments over 5 years. The types of financing for individuals are as follows:

1. Supplementary financing:

After paying 20% of the personal financing value, you can obtain a financing loan with amounts starting from 5,000 riyals and up to 1,500,000 riyals.

2. Financing with investment guarantee:

The National Commercial Bank of Saudi Arabia provides citizens and residents in Saudi Arabia with a financing service guaranteed by the investment portfolio, with amounts starting from 100 thousand riyals and reaching 3 million riyals.

3. Short-term personal finance:

Amounts up to 1.5 million riyals; repayable over 12 months.

4. Flexible installment:

Through this service, the maximum financing amount can be obtained based on a monthly deduction percentage, provided that the minimum salary of a Saudi citizen is 8,000 riyals.

5. Extended financing beyond retirement age:

The National Commercial Bank of Saudi Arabia allows customers who are about to retire to obtain a larger financing amount, and a repayment period of up to 5 years, extending beyond retirement age.

The requirements requested by the National Commercial Bank of Saudi Arabia vary when obtaining financing. For supplementary financing, the applicant must be at least 18 years old for Saudi nationals and 22 years old for non-Saudis when submitting the application. Financing that extends beyond retirement age is limited to Saudis only. The minimum age of the applicant must be 40 years, and the maximum age is 59 years. From this, we can deduce that the requirements change based on the services requested.