The Saudi Investment Bankwas established by royal decree in June 1976, but commenced operations in March 1977. Since that date, SAIB has endeavored to provide all its customers with excellent services and has the ability to develop its banking performance and continuously improve the quality of its services.

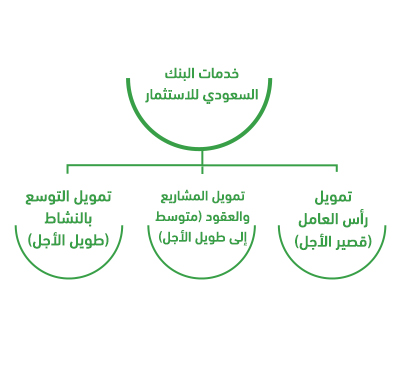

The Saudi Investment Bank (SIB ) offers many financing services for individuals, companies, and small and medium enterprises. Below, we will review what is important to Mashreq customers regarding the financing services provided by SAIB for SMEs:

1. Working capital financing (short-term):

Working capital financing is important for business development and gaining a competitive advantage in fast-growing markets. The Saudi Investment Bank provides the financing required by companies and organizations to invest in their liquid assets. This financing includes short-term loans and refinancing through short-term loans.

2. Project and contract financing (medium to long term):

The Saudi Investment Bank provides financing for projects during their various stages of construction, operation and maintenance. This financing covers letters of guarantee, invoice discounting, and the provision of letters of credit required to finance imports.

3. Financing the expansion of the activity (long-term):

The Saudi Investment Bank provides advisory and financing services related to the establishment and expansion of projects. These services include commercial loans, financing loans, project-related letters of credit, as well as currency risk protection tools.

Note:

– Short-term financing is subject to a 5% to 7% markup in addition to the SIBOR.

– Medium-term financing is added to its value at a rate of between 6% and 8% plus SIBOR.

Kafala is a program launched by Saudi Industrial Development Fundin cooperation with Saudi banks, the program aims to promote financing for small and medium-sized enterprises within Saudi Arabia.

Documents required to obtain the services of the Kafala program:

– A copy of your national ID/residency card.

– Copy of the activity license.

– A copy of the commercial register.

– Copy of the Memorandum of Association if the organization is a company.

– A copy of the lease or ownership contract for the place of practicing the activity.

– Three years of audited financial statements (for existing projects).

– Funding application form.

– Copy of ownership documents (real estate, cars, etc.).

This service is in cooperation with the Agricultural Development Fund (ADF), and aims to provide multiple financing products and credit services from the Fund in partnership with the Bank in order to achieve food security and sustainability of natural resources. This agreement is an important step towards promoting agricultural development initiatives through sustainable financing means, which enables the Fund and the Bank to contribute to the development of the economic and agricultural sector, and realize the ideal partnership between the public and private sectors in the Kingdom, which is one of the strategic objectives of Vision 2030.

Documents required for service:

– Facility request letter.

– Sign the Credit Inquiry Declaration.

– A copy of the commercial register.

– Three-year audited financial statements (for existing companies).

– Activity statement (for the last twelve months).