The Saudi Industrial Development Fund (SIDF) was established in 1974 as a government financial institution to promote private sector investment opportunities, develop local industry and raise the level of its performance. This is within the framework of supporting the goals, policies and programs of industrial development in the Kingdom of Saudi Arabia.

The Saudi Industrial Development Fund (SIDF) supports many promising sectors such as mining and logistics. It is noteworthy that the funds paid by the fund as loans to investors amounted to 121.1 billion riyals, as of the end of December 31, 2020.

– Mining sector.

– Energy sector.

– Industry.

– The logistics sector.

Development Fund and Target Groups

(1) The first category:

It includes the following major cities: (Riyadh, Jeddah, Dammam, Jubail, Makkah, Yanbu, Ras Al Khair). The maximum financing limit is 15 years, and the Saudi Industrial Development Fund loan rate is 50%.

(2) The second category:

Cities with some economic advantages include Qassim, Al-Ahsa, Rabigh, Taif, Al Kharj Industrial City, Sudair Industrial City, and Medina (except Yanbu). The maximum financing period is 20 years. The Fund’s loan rate is 60%.

(3) The third category:

Economically promising regions and cities include: (Hail, Northern Borders, Al Jawf, Tabuk, Jazan, Najran, Bahah, Asir) and cities that are at least 150 kilometers away from major city centers and 70 kilometers away from the nearest second-tier industrial city. The maximum financing period is 20 years, and the SIDF loan rate is 75%.

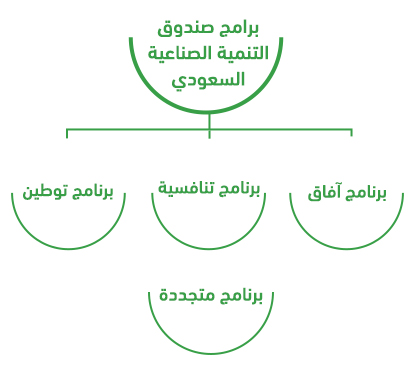

– Horizons program.

– Competitive program.

– Localization program.

– Renewable program.

– A thorough economic feasibility study.

– A valid industrial investment license.

– Documents required by technical advisors if needed. Namely: Quotations and contracts for machinery and equipment as well as customs clearance documents (if received).

– Raw material supply procedures and tooling supply agreement.

– Construction and civil works contracts and prices, engineering drawings and bill of quantities.

– A valid business registration.

– Articles of Association, company bylaws, or partnership agreement documents, notarized by a notary public (except for sole proprietorships).

– The personal solvency data of the owners/partners.

– Copies of the owner’s ID card.

– A valid project site lease agreement from the industrial city where the project will be built, and if the project is built on privately owned land, it is necessary to provide a valid copy of the building permit and the permit to operate the project on the proposed site, by the relevant authorities.

– The title deed if the project is on private land.

– Necessary legal agencies.

– Sales/marketing agreements, including export plans (if applicable).