The Saudi French Bank was established as a Saudi joint-stock company by royal decree in June 1977. It is one of the most widespread banks in Saudi Arabia, with 84 branches, including 4 women’s branches, and 563 ATMs.

The Saudi French Bank achieved a net profit of 1.55 billion Saudi Riyals for the fiscal year ending on December 31, 2020. The earnings per share (EPS) reached 1.28 Saudi Riyals in the same year, 2020.

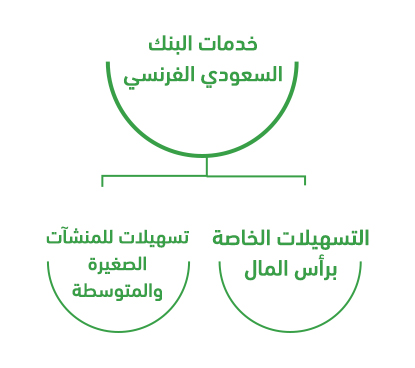

The Saudi French Bank offers all types of commercial banking services to both local and international clients in an innovative and distinguished manner, aiming to meet the financial needs of institutions and businesses.

First: Capital facilities.

The Saudi French Bank provides all capital-related facilities, allowing the client to obtain a range of medium-term loans with overdraft facilities, providing the necessary flexibility and ensuring the required liquidity for all their business operations.

Secondly: Facilities for Small and Medium Enterprises (SMEs):

The Saudi French Bank offers many financing services for micro, small, and medium-sized enterprises (SMEs), including short, medium, and long-term loans with an interest rate not exceeding 3% of the loan amount.

· Micro-enterprises

These are establishments that employ between 1 and 5 employees and have sales not exceeding 3 million Riyals.

Small businesses

Small establishments have sales ranging from 3 million to 40 million Saudi Riyals, with the number of employees ranging from 6 to 49 individuals.

Medium-sized enterprises

These are establishments with revenues starting from 40 million and reaching up to 200 million Saudi Riyals, and the number of employees is greater than 50 but less than 249 employees.

The bank targets supporting and financing several sectors that align with Vision 2030, such as: (the tourism sector, the sports sector, and the entertainment sector). It is important to note that the bank does not overlook traditional sectors like Hajj and Umrah, healthcare, and others. The main indicator for financing is the project’s profitability.

The requirements requested by Banque Saudi Fransi when obtaining financing vary, but there are mandatory elements for every service, such as:

A feasibility study for startup projects.

Audited financial statements for the last three years.

A positive credit record for the business owners.

Cash flow measurement and calculation.

Profitability of the activity.