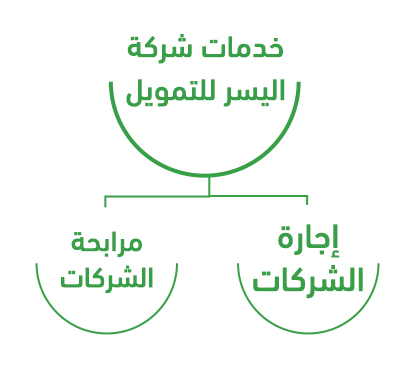

Al Yesser Finance Company was established in 1990 as one of the financing divisions of the Abdul Latif Alissa Holding Group of Companies. It is considered one of the most important options in the world of finance. Perhaps this is due to the leading role it plays at the level of the Kingdom, in providing many diverse financing services, compatible with the needs of individuals and companies.

1. Corporate leasing

Financing that allows organizations and SMEs to finance cars, selected goods, equipment, etc. through Al Yesser with easy installments.

2. Corporate Murabaha

Financing that allows organizations and SMEs to own cars, selected goods, equipment, and And others. This can be done through Al Yesser Company with easy installments.

– The age of the activity is 3 years or older.

– The minimum funding period is 1 year and the maximum is 5 years.

Required documents:

– A letter from the customer explaining the purpose of the financing and how to repay it.

– Fill out and sign the purchase application form for Murabaha and Ijara.

– Fill out and sign the credit facility application.

– A copy of the record to be borrowed and the master record.

– Photo ID for all partners.

– A copy of the value-added certificate.

– Audited financial statements for the last three years.

– The company’s articles of incorporation and partners’ resolutions.

– A copy of the Zakat certificate.

– A copy of the social insurance certificate.

– The license certificate related to the activity.

– List of owned vehicles (for the contracting, car rental and transportation sector).

– List of owned equipment (for the construction and industrial sectors).

– List of existing and finalized projects (for the contracting sector).

– Authorization to reconcile the bank statement (last 6 months statement).