The factory fills different types of juices (mango – berries – orange – strawberry – apple – pineapple – mix) used in the food and beverage sector, as the sectors targeted by the juice factory are diverse.

The factory fills different types of juices (mango – berries – orange – strawberry – apple – pineapple – mix) used in the food and beverage sector, as the sectors targeted by the juice factory are diverse.<Such as wholesalers, retailers, malls, restaurants and hotels, the juice factory aims to achieve self-sufficiency for the local market in juices and to provide new investment opportunities with good returns.<Employing the workforce and improving their economic and social level.<Achieving a high level of quality for the factory’s juice products and maintaining a competitive price level enables the project to obtain its target share.<And contribute to covering part of the increasing demand for juice products and using the latest methods in the field of juice products manufacturing.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

he GCC countries comprise 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages, amounting to $102 billion out of a total of $3.4 trillion. This indicates a high per capita food consumption in the region, exceeding the global average.

This is not surprising upon closer examination, as the population of the GCC now exceeds 58 million, with approximately 56.3% of them falling within the 25–54 age group. This key demographic is the driving force behind the food industry market, as it is the most dynamic and youthful segment.

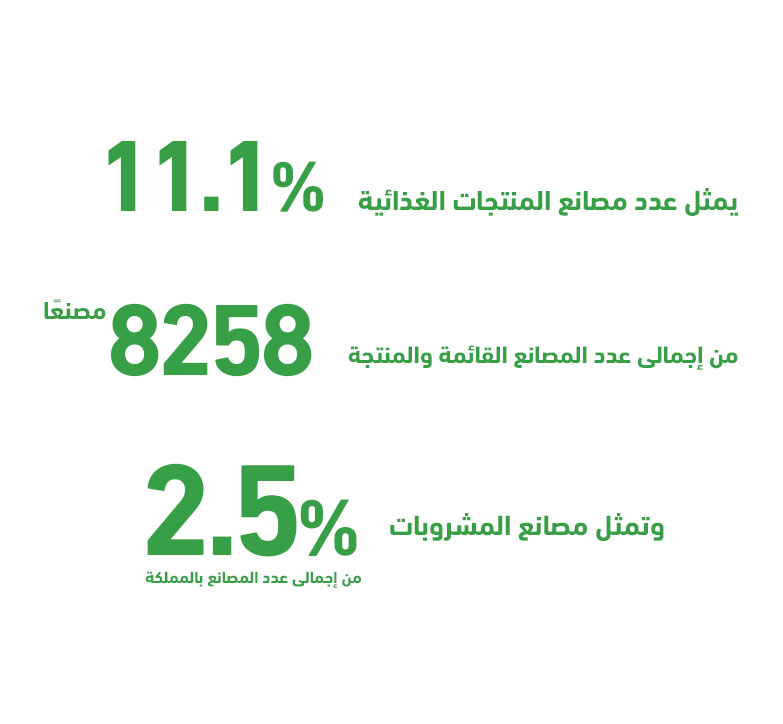

Since Saudi Arabia alone accounts for about 59.7% of the total GCC population and holds over 53% of the food and beverage market share, “Mashroo3k” has decided to present key indicators of this vital market in the Kingdom, based on the latest available statistics.