Mashroo3k Economic Consulting offers a feasibility study for a salt production and packaging plant project, ensuring the highest profitability and optimal payback period. The study is based on detailed analyses of the Saudi market size, assessment of local and international competitors’ strategies, and the ability to provide competitive pricing offers.

The project of a salt production and packaging factory is one of the projects that attracts the attention of the Saudi government and financing agencies in Saudi Arabia. The factory aims to produce and provide salt to several sectors. Like this: Pharmaceutical industries, laboratories, food factories of all kinds, dye and textile factories.

Mashroo3k Economic Consulting Company provides investors wishing to invest in a salt production and packaging plant project in Saudi Arabia, A range of specialized feasibility studies. It is based on up-to-date databases specific to the Saudi market. What makes a project successful. and maximize profitability. and the best payback period.

Consultants at Mashroo3k Economic Consulting Company point out that the diversity of sectors in which a salt production and packaging factory contributes makes it an attractive option for Saudi investors, in light of the state’s policies to revive the national industrial sector, with the possibility of developing the factory’s production lines, according to the latest international standards, which increases its opportunities for export and contribution to other important sectors. Like this: Animal feed industry, oil refining, and wastewater recycling plants.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

he GCC countries comprise 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages, amounting to $102 billion out of a total of $3.4 trillion. This indicates a high per capita food consumption in the region, exceeding the global average.

This is not surprising upon closer examination, as the population of the GCC now exceeds 58 million, with approximately 56.3% of them falling within the 25–54 age group. This key demographic is the driving force behind the food industry market, as it is the most dynamic and youthful segment.

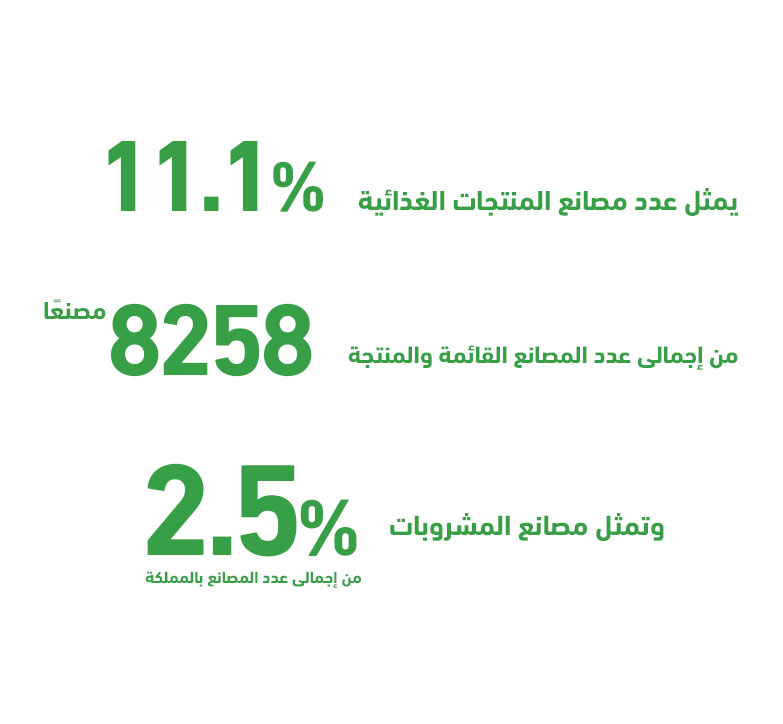

Since Saudi Arabia alone accounts for about 59.7% of the total GCC population and holds over 53% of the food and beverage market share, “Mashroo3k” has decided to present key indicators of this vital market in the Kingdom, based on the latest available statistics.