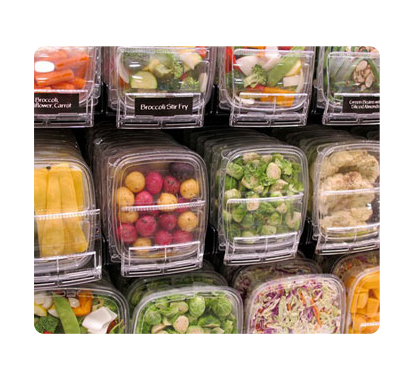

The project prepares and freezes vegetables suitable for freezing, such as beans, peas, broccoli, molokhia, and potatoes, in addition to freezing fruits, such as strawberries, mangoes, and berries. The frozen fruit and vegetable factory targets hospitals, health clinics, hotels, tourist villages, hypermarkets, supermarkets, and restaurants.

The project prepares and freezes vegetables suitable for freezing, such as beans, peas, broccoli, molokhia, and potatoes, in addition to freezing fruits, such as strawberries, mangoes, and berries. The frozen fruit and vegetable factory targets hospitals, health clinics, hotels, tourist villages, hypermarkets, supermarkets, and restaurants.<The frozen vegetable factory also aims, through exploiting the available resources of manual labor, to achieve a high level of quality for products and maintain a competitive price level that enables the project to obtain its target share, contribute to covering part of the increasing demand for frozen vegetables and use the latest technologies in the field of frozen vegetable packaging and training workers on them. Therefore, investing in the food sector is considered one of the major investment opportunities that achieve high economic returns.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

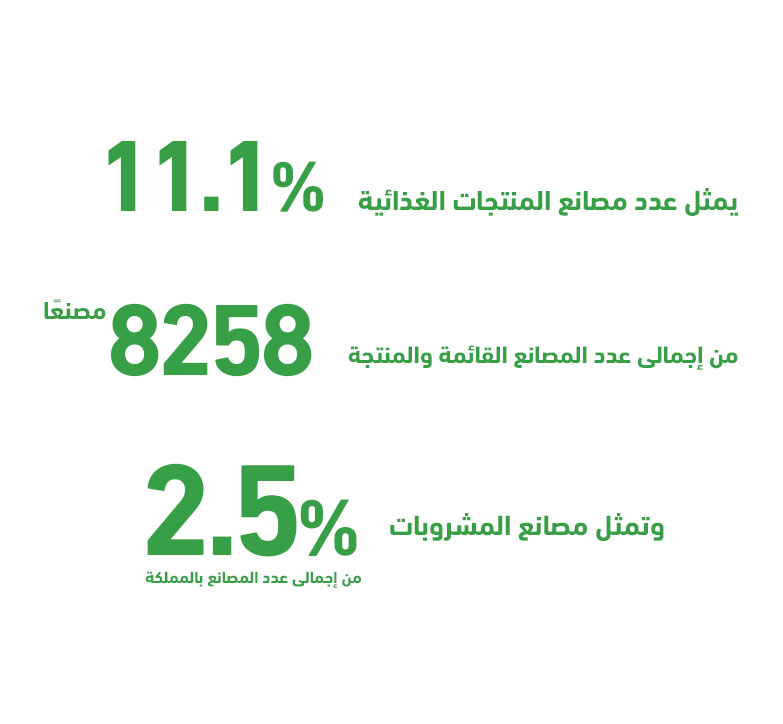

he GCC countries comprise 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages, amounting to $102 billion out of a total of $3.4 trillion. This indicates a high per capita food consumption in the region, exceeding the global average.

This is not surprising upon closer examination, as the population of the GCC now exceeds 58 million, with approximately 56.3% of them falling within the 25–54 age group. This key demographic is the driving force behind the food industry market, as it is the most dynamic and youthful segment.

Since Saudi Arabia alone accounts for about 59.7% of the total GCC population and holds over 53% of the food and beverage market share, “Mashroo3k” has decided to present key indicators of this vital market in the Kingdom, based on the latest available statistics.