It is the establishment of a radio station where the radio station works to broadcast and provide various radio programs, and the station is based on a team characterized by quality and high efficiency and under the supervision of an accuracy and discipline administration

The project involves establishing a radio station that broadcasts a variety of radio programs. The station relies on a highly skilled and efficient team, overseen by a management team known for its precision and discipline. The project aims to capitalize on the developments in the broadcasting and television sector. Radio, as one of the oldest means of human communication, has opened up global human relations and remains an effective medium for delivering educational, cultural, religious, entertainment, and informative programs. These programs can reach listeners across the world simultaneously, spreading a sense of energy and optimism. Therefore, setting up a radio station is considered a significant investment opportunity with high economic returns. The project targets all residents, as well as advertisers from companies, sports clubs, hotels, and factories. The demand for radio services is increasing and steady, driven by the growing population.

Executive Summary

Study of project services/products

Market size study.

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

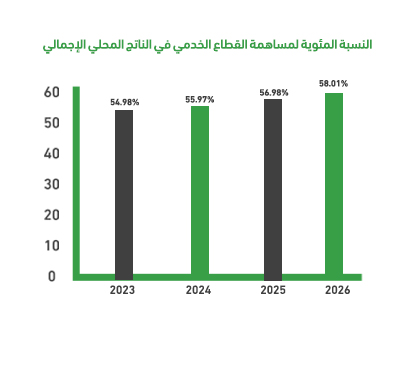

The service sector does not rely on raw materials or goods for sale; rather, its activities are centered around providing intangible services. Like this: Transportation services, hospitality services, healthcare services, and others. This sector is considered the main driver of major economies; for example, in the United States, the service sector accounts for 85% of the GDP. As for the service sector in Saudi Arabia, statistics and indicators confirm its contribution of about 48.02% to the GDP. This vital sector includes five main activities.

Namely:

The Gross Domestic Product (GDP) in Saudi Arabia reached 2,625,442 million SAR, with the “Wholesale and retail trade, restaurants, and hotels” sector contributing approximately 10.8% (284,579 million SAR).

Contributes approximately 6.6% (172,304 million SAR).

The Financial, Insurance, Real Estate, and Business Services sector contributes approximately 6.4% (SAR 377,725 million) to the Gross Domestic Product (GDP).

This sector contributes approximately 2.5% (SAR 65,729 million) to the Gross Domestic Product (GDP).

It contributes 21.9% (SAR 576,089 million) to the Gross Domestic Product (GDP).