The wedding dress rental project is a unique investment opportunity that meets the needs of brides on the night of their lives, by offering an exceptional collection of dresses that combine modern elegance with unique designs that suit all tastes. The project also offers a rental service for accessories that complement the bride’s look, such as lace-decorated veils, luxurious crowns, jewelry, elegant bracelets, scarves, and bags, making the project an ideal destination for every bride. The project will provide flexible rental options for its clients, and given its vital location, its dresses keeping up with the latest fashion trends, and competitive prices, the project will ensure a great turnout from girls and women.

The wedding dress rental project is a unique investment opportunity that meets the needs of brides seeking luxurious dresses in line with the latest fashion trends, along with a complete range of accessories such as crowns, veils, jewelry, shawls, bags, and shoes. Mashroo3k Consulting offers a comprehensive feasibility study for the wedding dress rental project, following the highest global standards in the field. The company employs a meticulous and comprehensive methodology that ensures all aspects necessary for the success of the project are covered, leveraging a vast database that encompasses all markets in the Middle East, helping to anticipate future market trends. With a team of specialized experts and consultants, Mashroo3k ensures the provision of integrated solutions that contribute to achieving sustainable success for this project. Additionally, the company offers its clients the opportunity to collaborate with suppliers from over 22 countries to supply project owners with everything they need from global fashion houses at unbeatable prices, making it an ideal partner for anyone wishing to invest in this project.

Executive Summary

Study of project services/products

Market Size Study

Risk assessment study.

Technical study

Financial study.

Organizational and administrative study.

According to the macroeconomic theory of sectors, the economy is divided into three main sectors:

The first sector is based on the extraction of raw materials and includes mining companies, lumber companies, oil exploration companies, as well as agricultural industries and fishing.

The second sector relies on goods and their sale… Like this: (…such as automobile manufacturing, furniture, clothing trade, etc.).

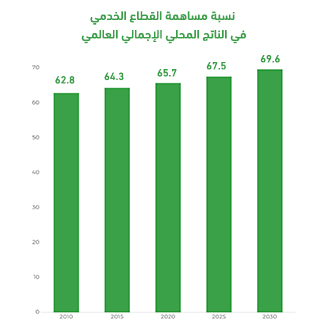

The third sector, known as the “services sector,” is responsible for providing and producing services, relying fundamentally on intangible elements. Like this: Entertainment, healthcare, transportation, hospitality, restaurants, etc. This theory holds that the more advanced countries become, the more their economies will be based on the third sector, unlike primitive countries, which rely heavily on the primary sector (the United States of America, for example, has a service sector that makes up 85% of its economy).

Kingdom of Saudi Arabia:

The service sector is considered a large sector when we take a closer look at its activities. It includes wholesale and retail trade, restaurants and hotels, transportation, storage, information and communications, financial services, insurance, real estate, business services, community, social, and personal services, and finally, government services. Below, we will present the key indicators of the sector in Saudi Arabia.

The State of Qatar:

State of Kuwait:

United Arab Emirates:

Sultanate of Oman:

Kingdom of Saudi Arabia: