On the 29th of Muharram 1430 AH, the Council of Ministers issued a decision to establish the Agricultural Development Fundas a governmental credit institution specialized in financing various fields of agricultural activity, with a capital of up to 20 billion riyals – subject to increase.

The Agricultural Development Fund aims to ensure the continuity of agricultural activity, support and address troubled agricultural projects by providing interest-free soft loans to farmers and facilities to obtain agricultural machinery, cattle, poultry, sheep, beekeeping equipment, and fish, and targets the agricultural sector with all its plant, animal, and fish projects and activities.

– Fund Policy:

The Fund’s policy in the (Medium Term Loans) category aims to lend to investors at 100% if the required cost is within SAR 200,000. Then 75% if the required cost exceeds SAR 200 thousand. Then 50% if the required cost exceeds SAR 200,000. As for specialized agricultural projects, they are financed at 75% for the first three million riyals of the cost of the project according to the bank’s study, then at 50% for more than that; but with a maximum of 20 million riyals as the total value of the loan.

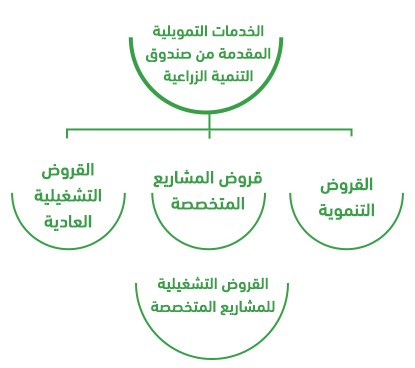

(a) Development loans:

These are loans that are provided to finance agricultural fields for the purpose of growing crops, fruit farms, apiaries, fishing boats, tourism loans, and veterinary clinics and pharmacies. It is worth mentioning that these development loans are long-term services that are granted as a direct loan.

Among its conditions:

Possession bonds.

A license to practice the profession.

Provide guarantees.

(b) Specialized project loans:

These are projects in which economic resources are invested to build and manage productive structures with the aim of obtaining an annual return in a specified period. It is granted as a direct loan for specialized projects, project rehabilitation and expansion. The service requires an economic feasibility study and a license from the Ministry of Environment, Water and Agriculture. The repayment period for specialized projects is determined based on cash flow, project study, and credit analysis.

Another requirement for this service is for individuals:

An electronic copy of the economic feasibility study that is accurate and shows the technical, financial and marketing study of the project.

Agricultural record issued by the Ministry of Environment, Water and Agriculture.

A copy of the national ID card.

Applicants must be at least 21 years old.

A cadastral elevation of the project land from an accredited engineering office showing all coordinates.

Provide proof of the client’s financial solvency.

Integrated engineering plans for the project.

It is important to note that there are different requirements for corporations and associations.

(c) Regular operating loans:

These are loans that cover the operational costs of a single production cycle for small businesses, and whose repayment period does not exceed one year. They are short-term loans that are granted as a direct loan.

Among the projects that fall under this service: (livestock and beekeeping).

(d) Operating loans for specialized projects:

It is one of the important services provided by the Agricultural Development Fund (ADF) through which it provides the opportunity to obtain a direct loan to finance working capital. It is a short-term credit service that covers the operating costs of a single production cycle, with a repayment period not exceeding two years, and is granted for certain activities. Like this: Pharmacies and veterinary clinics.

(1) External investment:

is a programme to diversify and stabilize external food supply sources as part of the Kingdom’s food security initiative. Pending loan 10 years with grace period up to two years. The Fund contributes approximately 60% of the project’s cost.

(2) Handling of distressed projects:

The idea is to address distressed projects in cooperation with the Ministry of Environment, Water and Agriculture and investors wishing to invest in these projects by reintroducing projects to other investors. There are many solutions to this:

_ Scheduling of distressed debt premiums.

_ Transfer indebtedness to a new investor.

_ Leasing the project to an investor who wants to invest without transferring ownership.

(3) Products and Services Initiative:

The Fund works to meet clients’ needs and supply them with various lending products:

_ Medium term loans.

_ Short-term (operational) loans.

_ Working capital loans (less than one year).

Credit facility loans in cooperation with commercial banks.

Financing conditions from the Agricultural Development Fund

Long-term Finance:

· Agricultural registry from the Ministry of Environment, Water and Agriculture and licence to engage in activity.

· Title to the acquisition or ownership of agricultural land.

· Site coordinates.

Short-term funding:

· The applicant shall not be a government employee or private sector employee.

· Exclude retirees from receiving this service if their pension is more than SAR 10 thousand.

· The applicant shall not be less than 21 years of age or more than 75 years of age.

We conclude that the conditions for obtaining financing from the Agricultural Development Fund vary depending on the project, service and sector: animal, fish farming, poultry.