In 1971, a royal decree was issued to establish the Credit Bank. In 2013, the bank’s capital increased to SAR 46 billion. In 2016, the name of the Credit Bank was changed to the Social Development Bank.

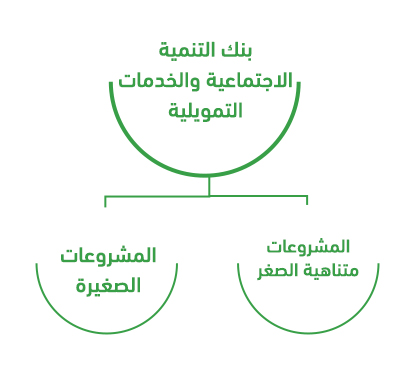

The Social Development Bank (SDB) contributes to supporting startups and small businesses in Saudi Arabia through a number of development financing programs.

– Microenterprise

Microenterprise sales are up to SAR 3 million. The Social Development Bank provides financing services for these projects up to SAR 4 million.

– Small Businesses

Small business sales range from SAR 3 million to SAR 40 million. The Social Development Bank has set the maximum limit for financing these projects at no more than SAR 10 million.

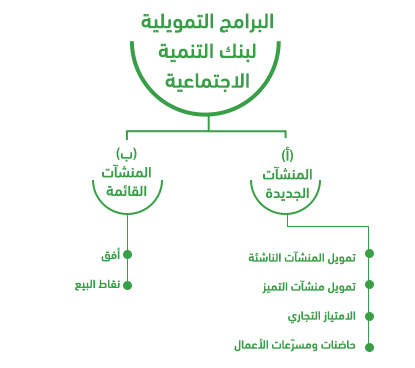

(a) New installations:

The Social Development Bank offers a variety of financing options, depending on the stage of growth and size of the business:

– Startup funding: Targets new businesses with funding of up to SAR 300,000.

– Funding for Excellence: Targets promising enterprises (new or less than 3 years old) with funding of up to SAR 4 million.

– Franchising: Targets the development of franchise projects with funding of up to SAR 4 million.

– Incubators and accelerators: Targets incubators and accelerators with funding of up to SAR 4 million.

(b) Existing facilities:

Here, the Social Development Bank offers some important and diverse options, which are in line with the size of the existing organizations:

– Horizon: The Social Development Bank developed this financing product with the aim of assisting enterprises whose actual years of operation exceed 3 years or more, and whose sales range between 3 million and 40 million riyals. The financing here is up to a maximum of SAR 10 million. Financing is done in two ways: (1) Short-term financing to support the operational cycle of the facility with a repayment period of no more than one year. (2) Long-term financing to support capital expansions with a repayment period of no more than five years.

– POS: Fast funding for businesses based on POS device flows.

To obtain financing from the Social Development Bank, it is essential to present everything that demonstrates the practical feasibility of the project if implemented. This is provided by a comprehensive feasibility study, which can determine the costs, benefits, and net profits of the project before its execution.

The applicant must be a Saudi citizen.

The applicant must be at least 18 years old.

The applicant should not own any other business except the one they are seeking financing for or be a partner in any other project at the time of application.

The applicant must not apply for financing from multiple bank programs at the same time.

The applicant must be fully dedicated to running their business.

For anyone wishing to invest in a relatively new sector, such as electronic applications or platforms, a comprehensive feasibility study should be prepared to prove that the project will yield benefits and profits if implemented.

Are there projects that do not require a feasibility study?

The Social Development Bank waives the feasibility study requirement for projects with a financing request not exceeding 300,000 SAR, such as wholesale and retail businesses. However, for projects requiring more than 300,000 SAR in financing, a comprehensive feasibility study must be submitted.